In today’s financial landscape, making knowledgeable investment decisions is crucial. An ROI calculator is an essential tool that accurately determines investment profits. By using it, you can evaluate multiple investments, identify under performing assets, and allocate funds strategically to maximize returns. A thorough understanding of these tools helps investors minimize risks and enhance profitability effortlessly.

Table of Contents

ToggleROI Calculator

What is Return on Investment(R.O.I)?

Here’s a simple breakdown of ROI in table form to make it easier to understand:

| Term | Definition |

| ROI (Return on Investment) | A measurement that indicates whether profits or losses were incurred from a specific investment. |

| Purpose | Measures conversions through advertising and evaluates investment performance. |

| 100% ROI | Means the investment has produced a return that fully covers its cost. |

| Importance | Helps investors make informed decisions and manage portfolio returns wisely over time. |

The Importance of Calculating ROI

ROI is a powerful tool for evaluating investments and making informed financial decisions. It helps you compare different opportunities, ensuring your money is directed toward the most profitable ones.

Investment Comparison

Understanding ROI allows you to assess the profitability of various investments, helping you choose the most rewarding options.

Performance Evaluation

Regularly calculating ROI enables you to track investment performance, identify underperforming assets, and make necessary adjustments.

Strategic Planning and Resource Allocation

ROI plays a key role in strategic planning, ensuring efficient resource allocation and maximizing financial growth.

ALSO READ : How Accurate Is The NVIDIA Stock Calculator? 3 Key Insights

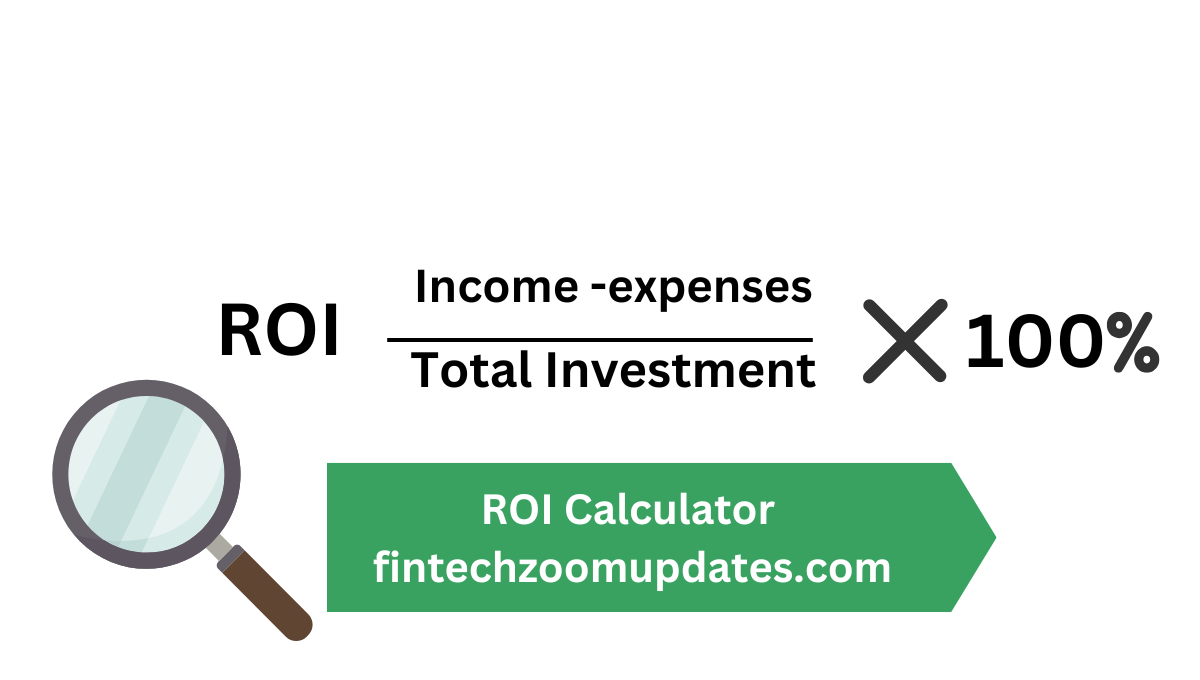

How to Calculate ROI

The formula for calculating ROI is straightforward:

| Component | Explanation | Example Calculation |

| Initial Investment | The total amount spent on an investment, including all costs. | $1,000 |

| Net Profit | The earnings from the investment after deducting all expenses. | $200 |

| ROI Formula | (Net Profit / Cost of Investment) × 100 | (200 / 1,000) × 100 |

| ROI Calculation | The percentage return on the initial investment. | 20% |

Utilizing an ROI Calculator for Accurate Assessments

The Importance of an ROI Calculator When Evaluating Investments ROI becomes complicated without proper calculations. An ROI calculator ensures that investment calculations are completed accurately and effortlessly. You can select the parameters like starting investment, net return, and other factors to get your ROI in an instant. This helps in avoiding errors and saves time when multiple investments need to be evaluated.

Professional Tips for Choosing an ROI Calculator Choose wisely

as the ROI calculator features can be beneficial or useless based on your investment needs.

• Interface: The design should be simple enough for users to enter data and interpret the results with ease.

• Customization: Users should be able to modify variables and the types of investments that the calculator works with.

• Reports: They should provide a detailed analysis, including graphs, data comparisons, and more to make the report comprehensive.

• Platform: The tool should be available on other platforms like mobile phones and computers, not just the web.

Most Common Errors with ROI Calculators

Make sure you avoid these mistakes for more accurate results:

Failing to Consider Extra Expenses: Not accounting for direct and hidden costs will inflate ROI estimates, which is why every expense needs to be considered.

Overlooking Time Factors: Consider the investment duration, as ROI does not inherently account for the time value of money.

Misinterpreting Results: Understand that a high ROI does not always equate to a low-risk investment; assess all factors comprehensively.

Real-Life Applications of ROI Calculators

ROI calculators are versatile tools applicable in various scenarios:

- Business Investments: Evaluating the potential return on new projects or expansions.

- Stock Market Analysis: Assessing the profitability of purchasing specific stocks or bonds.

- Real Estate Ventures: Determining the return on property investments, including rental income and appreciation.

- Marketing Campaigns: Measuring the effectiveness of advertising expenditures in generating revenue.

Case Studies: The Success Behind ROI Calculators

Case Study 1: Center Point Real Estate

• Background: One of the investors purchased a rental property with $30,000 down payment and assumed a mortgage for $30,000. The property cost $250,000 for rent. After maintenance was factored in, the yearly rental income stood at $30,000. The property investment also incurred $275,000 tax on money spent. After expenses, net profits after spendings rounded to $25,000 per year.

• ROI Calculation:

• Outcome: By using ROI calculators, the investor was able to compare different properties and target ones with a higher ROI of 25%. At first, they were determined to 30% ROI, however, using ROI calculators substantially improved their investments.

Case Study 2: Social Media Marketing Campaign

• Background: The company allocated $10,000 for advertisement spend and via promotion was able to achieve $50,000 in money earned. Therefore the profit after $10,000 expenditure is was $30,000.

• ROI Calculation:

• Outcome: From increased advertisement spending, the company in return was able to earn even higher, demonstrating the effectiveness of higher budget spending.

Streamlining Financial Strategy Through ROI

Incorporating ROI analysis into your financial planning enables you to:

- Optimize Resource Allocation: Direct funds toward investments with higher returns.

- Mitigate Risks: Identify and avoid underperforming assets or ventures.

- Set Realistic Goals: Establish achievable financial objectives based on projected returns.

ROI vs. Other Financial Metrics

While ROI is a valuable metric, it’s essential to consider it alongside other financial indicators:

- Net Present Value (NPV): Accounts for the time value of money, providing a dollar amount rather than a percentage.

- Internal Rate of Return (IRR): Focuses on the interest rate at which the net present value of an investment is zero.

- Payback Period: Calculates the time needed to recover the initial investment from generated returns..

Each metric offers unique insights, and a comprehensive analysis often involves evaluating multiple indicators.

Using ROI Calculators for Planning Ahead

Frequent use of ROI calculators helps with:

Monitoring Performance: Tracking how one’s investments are performing over a set period of time.

Changing Direction: Performing careful adjustments to investment portfolios and business plans.

Estimating Results: Estimating the possible returns for expected investments resourced for a particular activity

In Conclusion

For both personal investments as well as in business projects, the ROI calculator serves as an essential instrument for success. The framework works to the advantage of those who seek to increase profitability, make well-informed spending decisions, as well as optimize resource allocation.

In addition, considering that ROI can be one of the most useful measuring tools, it is important to use it with other financial ratios in order to monitor investment activity effectively. It is highly recommended that whenever one has a chance to use readily available technology, scooping that technology can remarkably improve one’s financial standing, especially within institutions.

ROI enables businesses to shift their focus to making more sound decisions which will in turn, ensure that the desired results are achieved.

Don’t wait any longer, embrace an ROI calculator today and ensure a positive shift in your finances!

FAQ SECTION

Q-1 How to Turn $1,000 into $5,000 in a Month?

Getting from $1,000 to $5,000 in a month may sound impossible, but it is achievable with some planning and careful execution. Here are some ways to do it:

Crypto & Stock High-Volatility Trading

Traders whose buying and selling strategies center on volatile stocks may greatly profit. The risks, however, are grave.

A hypothetical example: Return of 500%, that is, turning $1,000 into $5,000.

Risk To Consider: Investments may be lost during market crashes.

Options Trading and Leverage

Options trading gives traders the ability to make aggressive profits through minimal investments.

Hypothetical Example: Contracts can be bought as options on stocks that show high growth.

Risk To Consider: Very speculative.

Dropshipping and E-Commerce

Starting a dropshipping store and advertising on platforms like Facebook can bring you up to $10,000 in revenue.

Com risk to consider: Marketing can become expensive and have a negative impact on your profits.

Side Hustles or Freelancing

Consider high paying freelance work in consulting, copywriting or graphic design to earn $4,000.

Example: $500 per project for a total of 10 projects means $5,000.

Risk To Consider: A modest bet, but does require work and skill.

Reselling and Flipping

These can include shoes, collectibles, and electronics. Some people earn a lot from buying and selling underpriced goods.

For instance, purchasing ten cellphones at $100 a piece and then selling them for $500 each.

Risk: Requires finding good deals and reliable buyers.

Pro Tip: If you’re looking for low-risk methods, focus on long-term investments rather than trying to multiply money quickly.

Q-2 What Does 70% ROI Mean?

A 70% ROI means your investment has grown by 70% of its original value. If you invested $1,000, a 70% ROI would mean:

1,000 × (70/100) = $700 profit

So, your total investment value is now $1,700. This is a very high return and could indicate a successful but potentially high-risk investment.

Q-3 Is 30% ROI Good?

Yes! A 30% ROI is very strong in most investment scenarios. It means you’re earning 30% profit on your initial investment. Here’s what it means for different types of investments:

- Stock Market: 30% in a year is outstanding, as the average annual return is around 8-10%.

- Real Estate: A 30% ROI can be exceptional, depending on rental income and appreciation.

- Business Ventures: It depends on industry benchmarks, but 30% is typically strong.

However, higher ROI often comes with greater risks, so always analyze your risk tolerance.

Q-4 -Is 100 ROI Doubling Your Money?

Yes! A 100% ROI means you’ve doubled your money. If you invest $5,000, a 100% ROI would mean:

(5,000 × 100/100) = $5,000 profit

Total investment value: $10,000

A 100% ROI is fantastic, but achieving this consistently requires smart investing strategies and risk management.

Q-5 How much would $20,000 be equivalent to a decade from now?

| Parameter | Value |

| Initial Investment (P) | $20,000 |

| Annual Return Rate (r) | 8% (0.08 in decimal) |

| Compounding Frequency (n) | 1 (Annually) |

| Number of Years (t) | 10 |

| Formula Used | FV = P(1 + r/n)^(nt) |

| Final Value (FV) After 10 Years | $43,178 |

| Conclusion | With an 8% annual return, your $20,000 investment will grow to $43,178 in 10 years. If the return rate increases, the final amount will be even higher. |

Q-6 Is a return of 25% considered good?

| ROI Percentage | Evaluation |

| 25% | Excellent in most cases |

| Stock Market & Real Estate | Considered a very high return |

| Business Investments | Depends on the industry; some sectors operate on lower margins |

| High-Risk Investments | A strong return, especially for short-term investments |

| Example Calculation | A 25% ROI on $100 means a $25 profit |

| Final Verdict | If you consistently achieve a 25% ROI, you are making smart investment choices. |